Page 178 - claims information pack ebook_e

P. 178

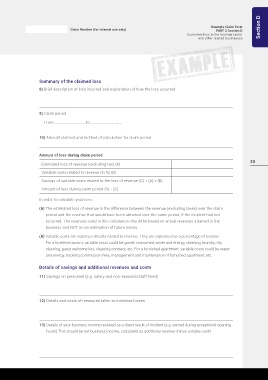

Example Claim Form Section D

Claim Number (for internal use only) PART 2 Section D

Economic loss in the tourism sector

and other related businesses

Summary of the claimed loss

8) Brief description of loss incurred and explanation of how the loss occurred

9) Claim period

From ...............................to ...............................

10) Amount claimed and method of calculation for claim period

Amount of loss during claim period

33

Estimated loss of revenue (excluding tax) (A)

Variable costs related to revenue (in %) (B)

Savings of variable costs related to the loss of revenue (C) = (A) x (B)

Amount of loss during claim period (A) - (C)

In order to calculate your loss:

(A) The estimated loss of revenue is the difference between the revenue (excluding taxes) over the claim

period and the revenue that would have been obtained over the same period, if the incident had not

occurred. The revenues used in this calculation should be based on actual revenues attained in the

business and NOT on an estimation of future losses.

(B) Variable costs are expenses directly related to revenue. They are expressed as a percentage of revenue.

For a hotel/restaurant, variable costs could be goods consumed, water and energy, cleaning, laundry, dry

cleaning, guest welcome kits, cleaning contract, etc. For a furnished apartment, variable costs could be water

and energy, booking commission fees, management and maintenance of furnished apartment, etc.

Details of savings and additional revenues and costs

11) Savings on personnel (e.g. salary and non-seasonal staff hired)

12) Details and costs of measures taken to minimise losses

13) Details of your business income received as a direct result of incident (e.g. earned during exceptional opening

hours).This should be net business income, calculated as additional revenue minus variable costs